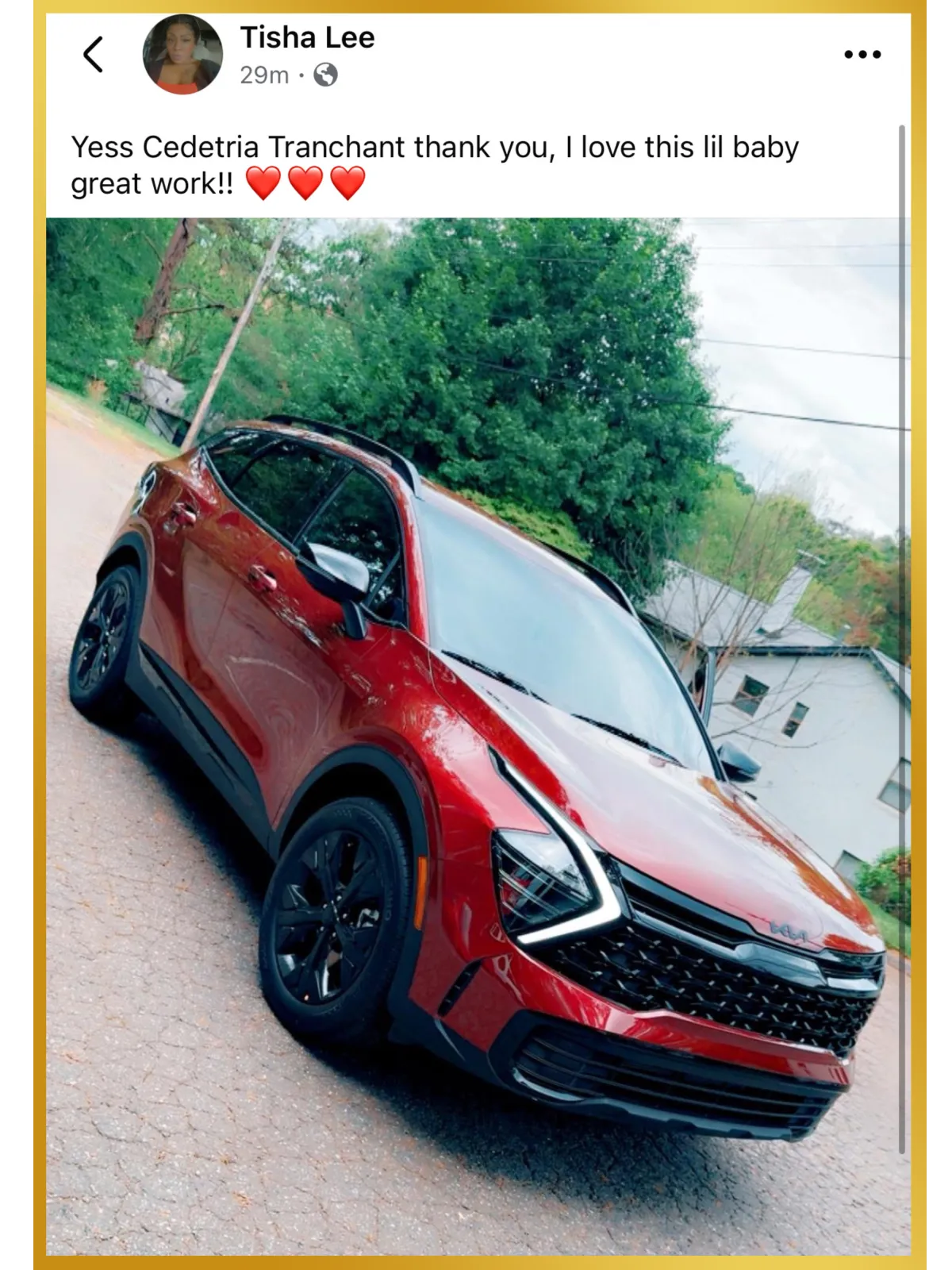

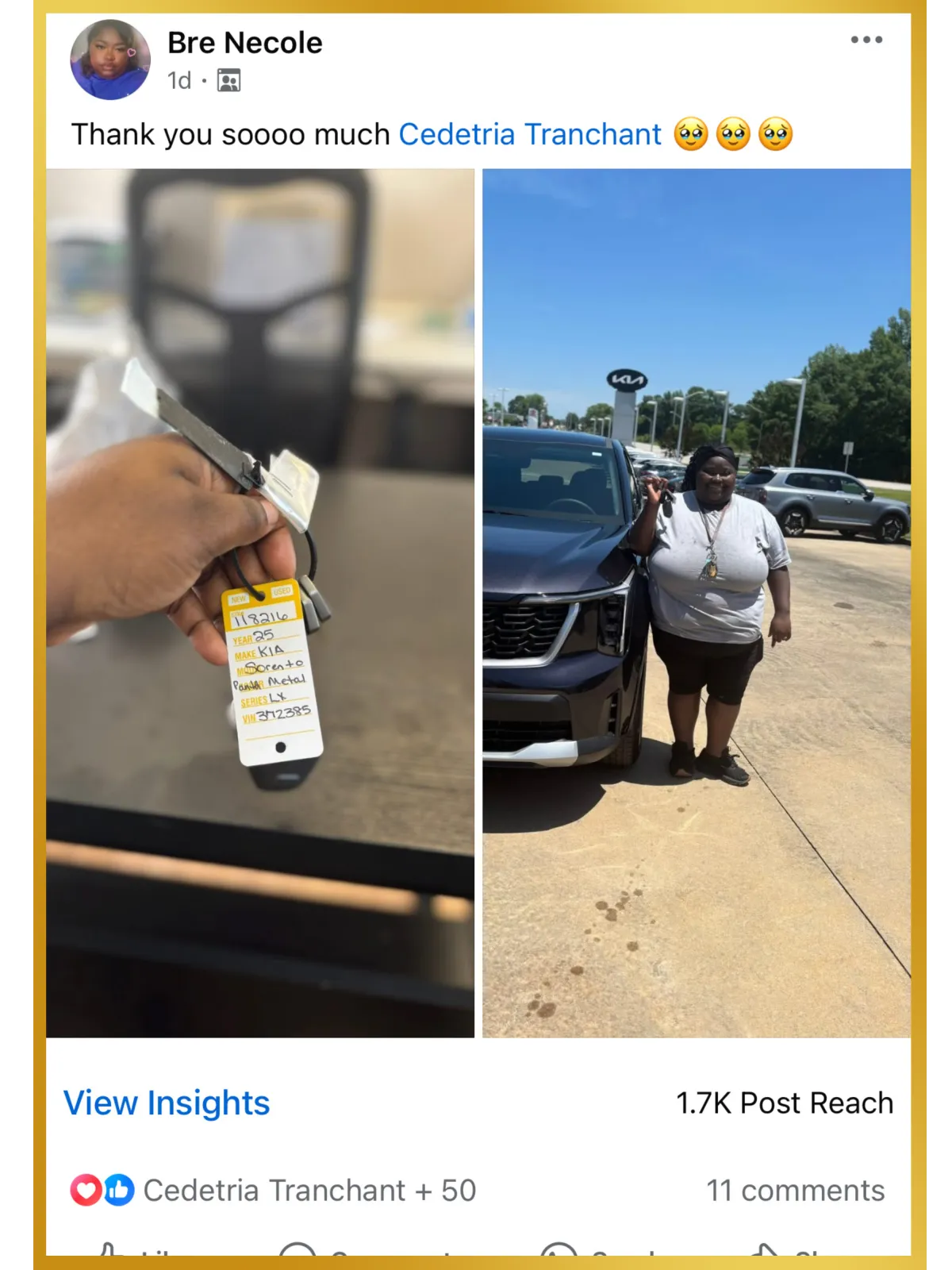

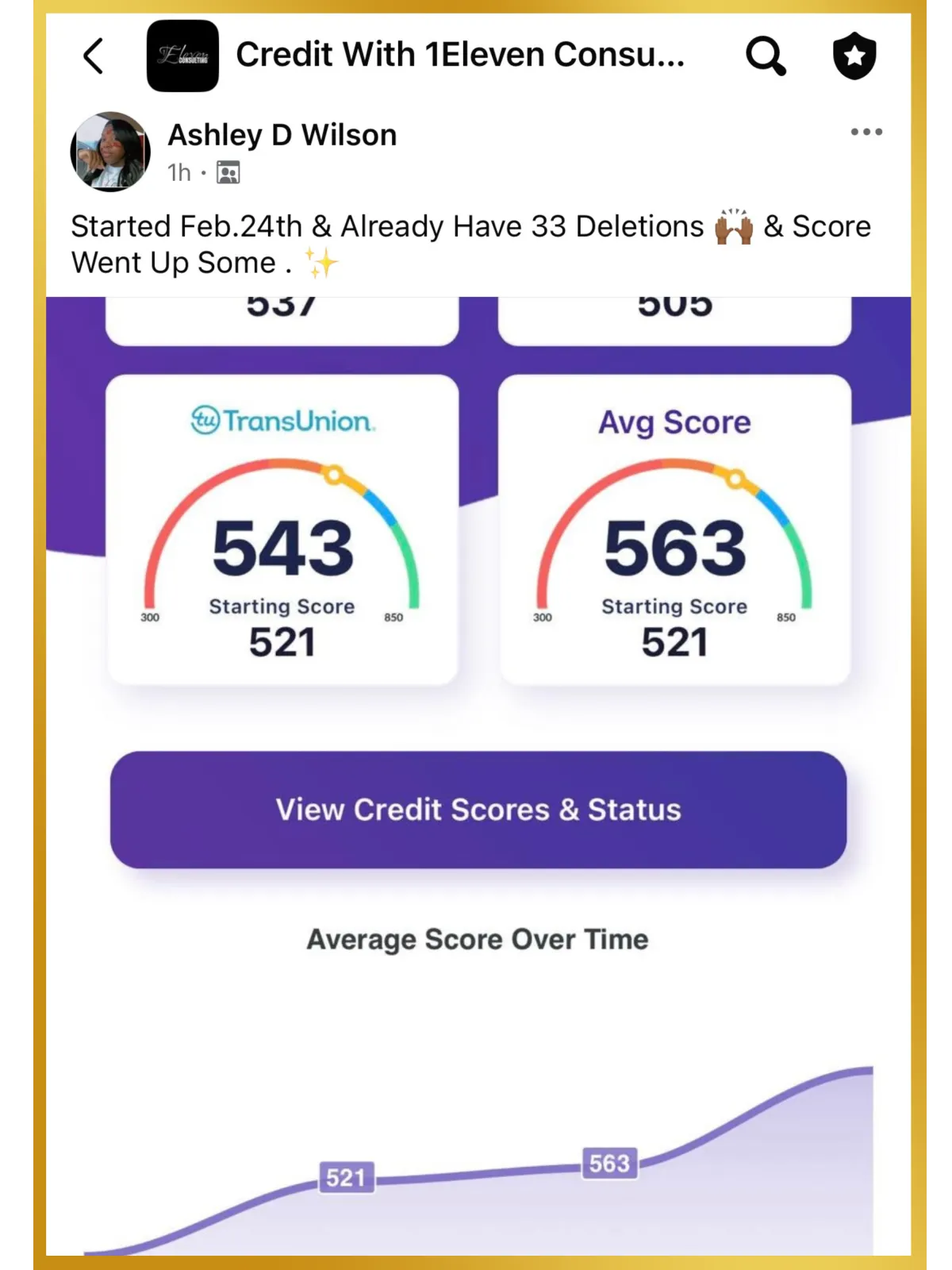

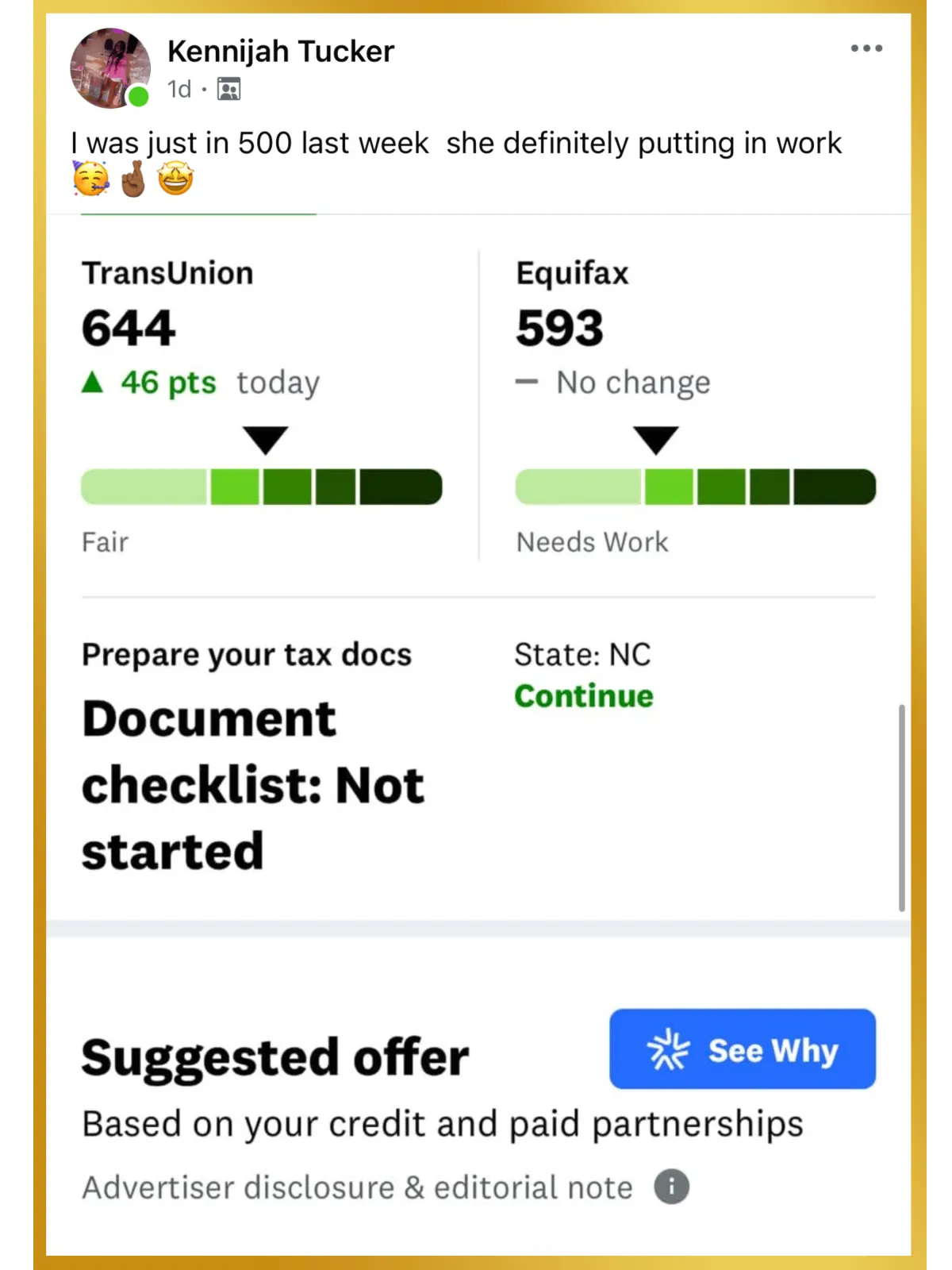

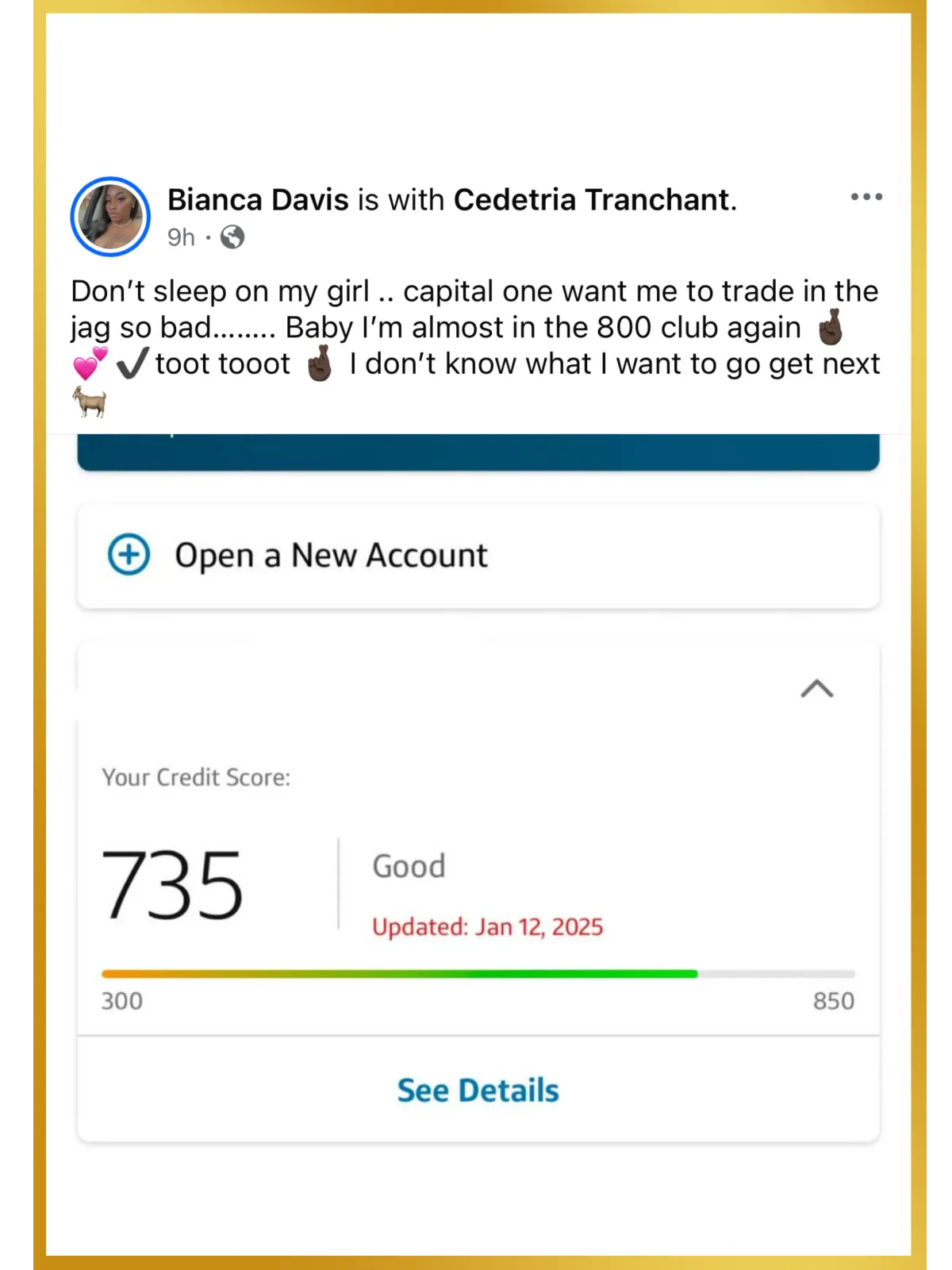

1,200+ Success Stories.

$5 Million in Debt Gone. Yours Could Be Next.

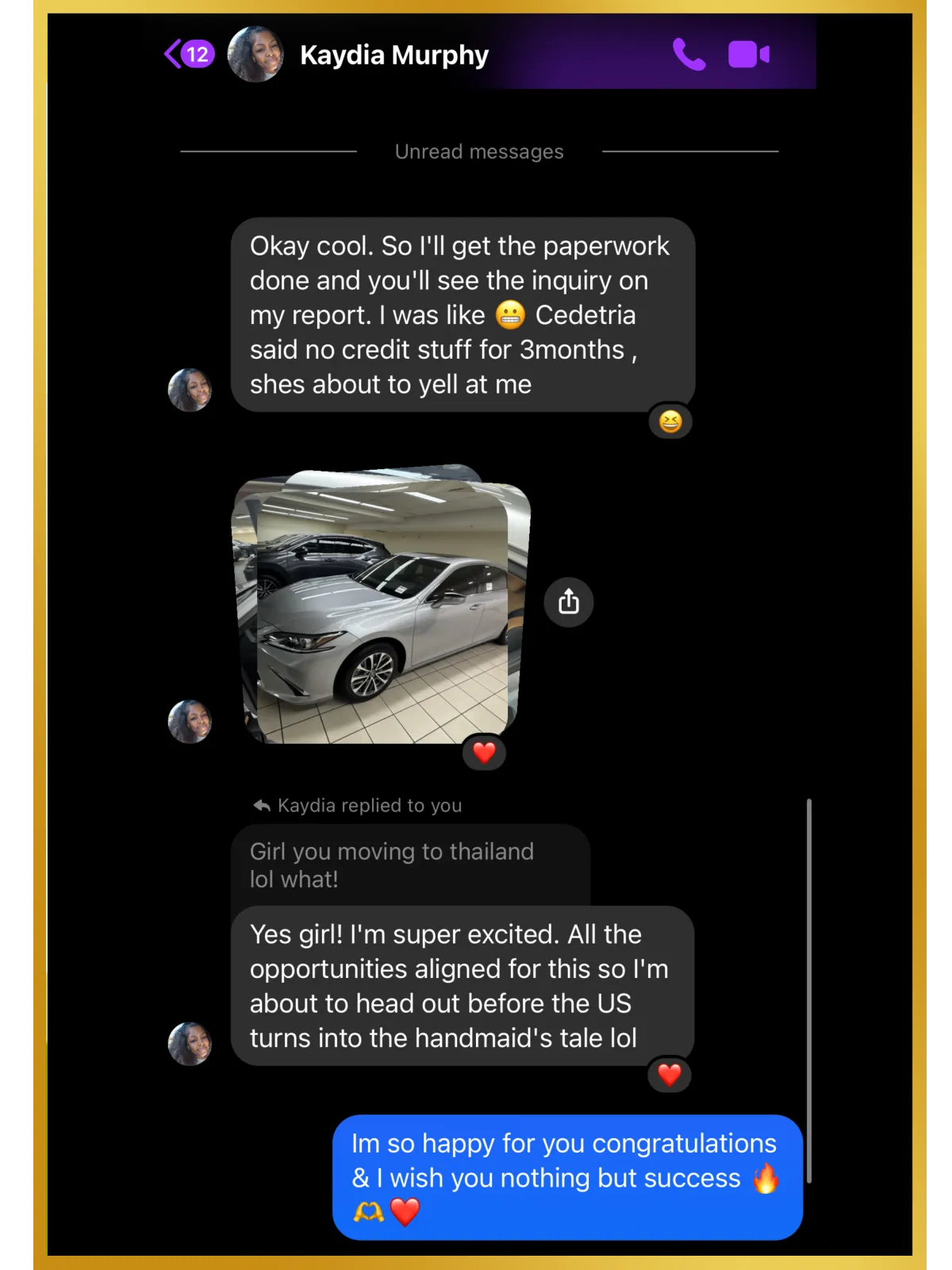

Get started with The Approval Accelerator™ today and see results in as little as 30 days — so you can move toward the home, car, and financial freedom you’ve been waiting for.

1,200+ Success Stories.

$5 Million in Debt Gone. Yours Could Be Next.

Get started with The Approval Accelerator™ today and see results in as little as 30 days — so you can move toward the home, car, and financial freedom you’ve been waiting for.

⚡Fast Results | 💰Millions in Debt Erased | 🎯Expert Credit Strategists | 🔍Radical Transparency

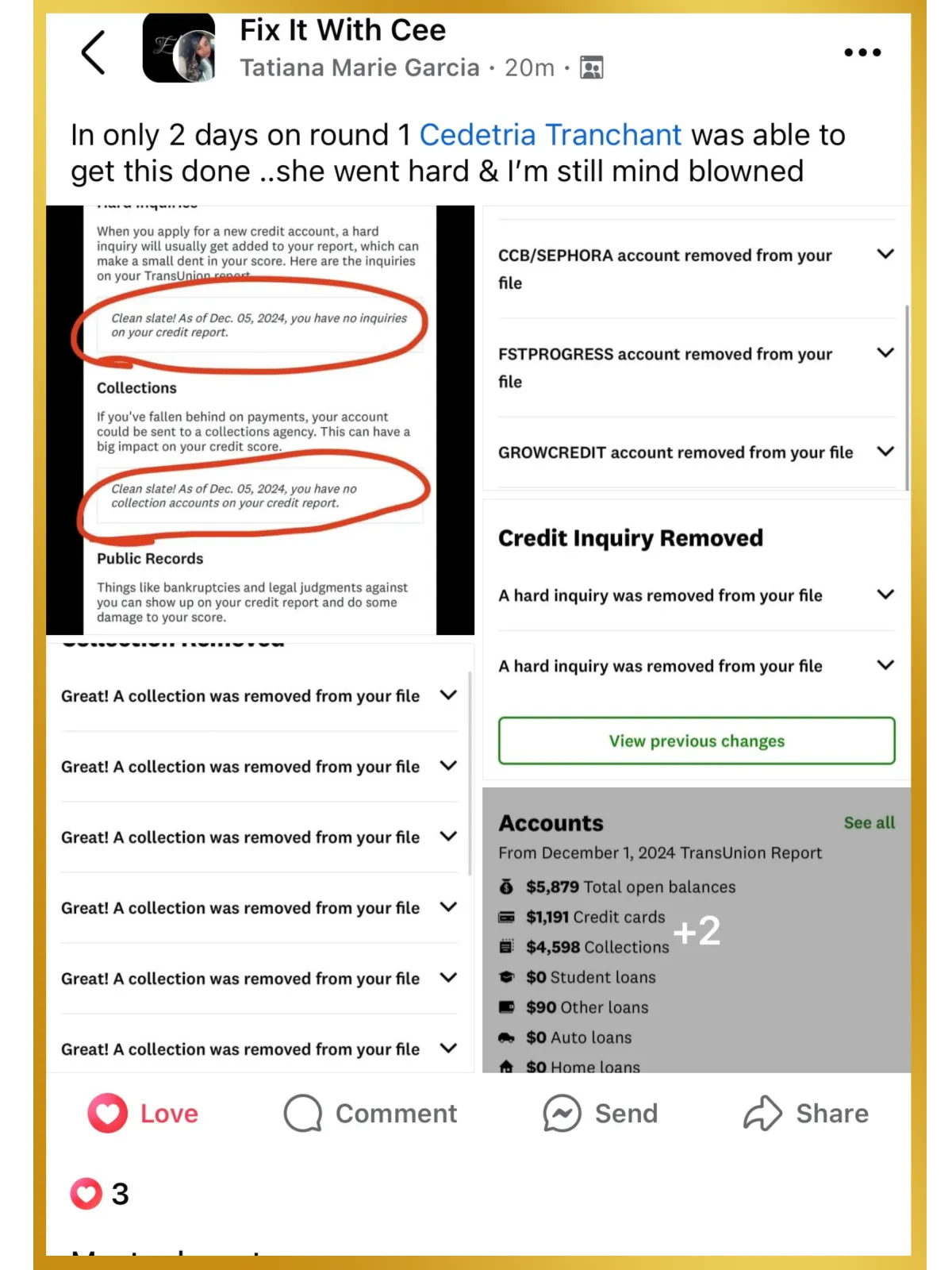

Over $5M+ in Negative Debt Removed

We’ve helped over 1,200 clients have erased collections, late payments, and more — for good.

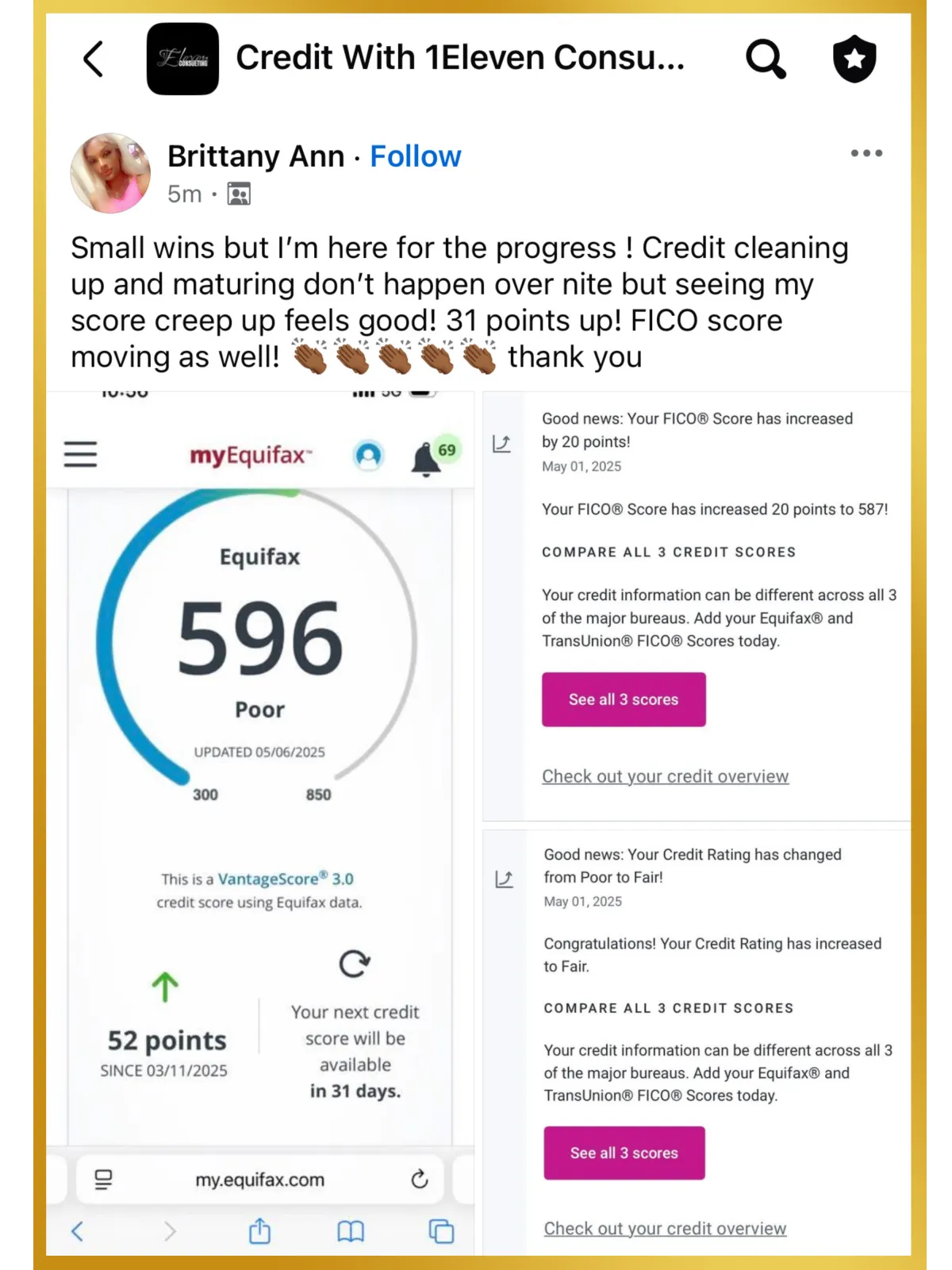

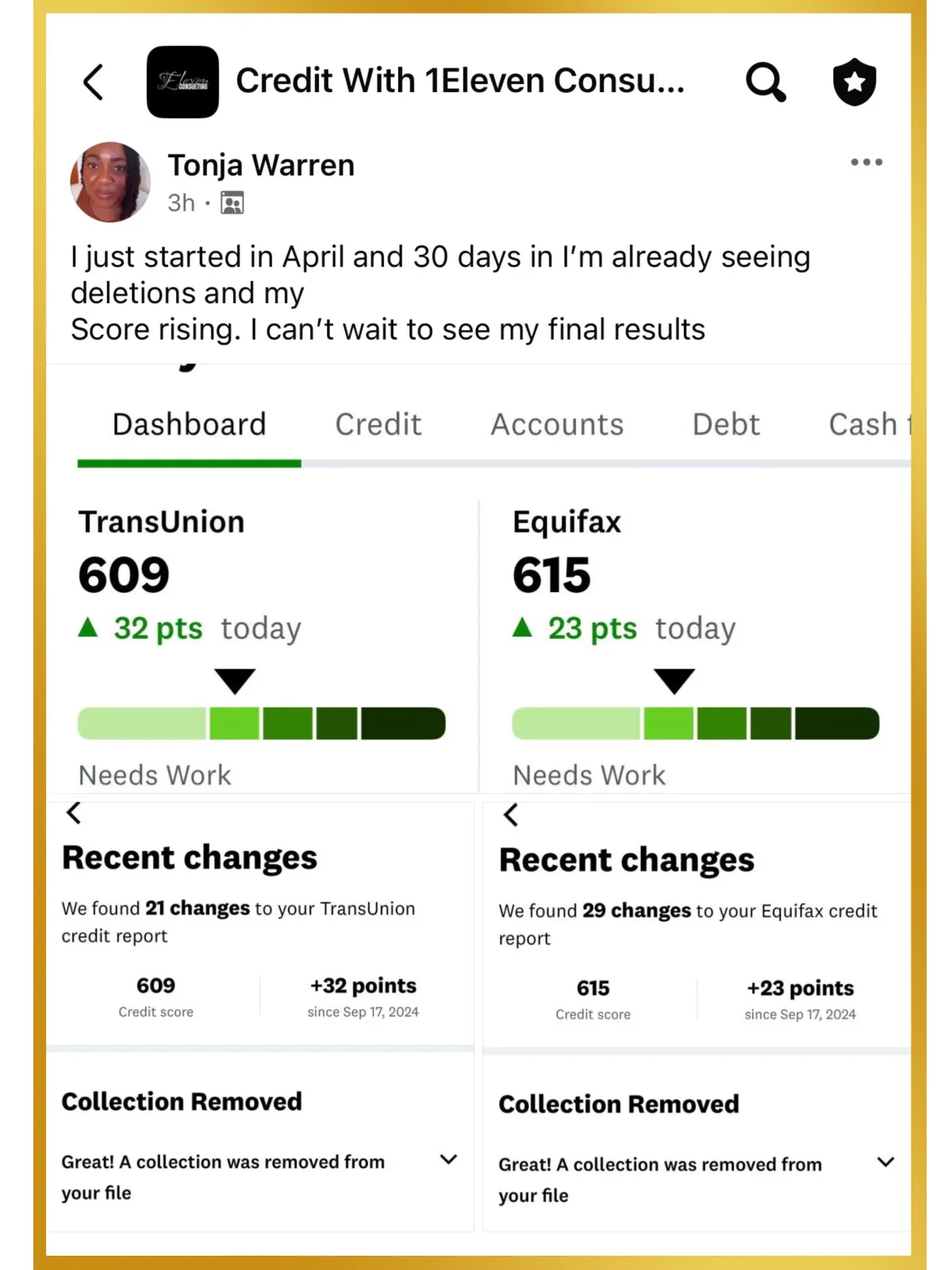

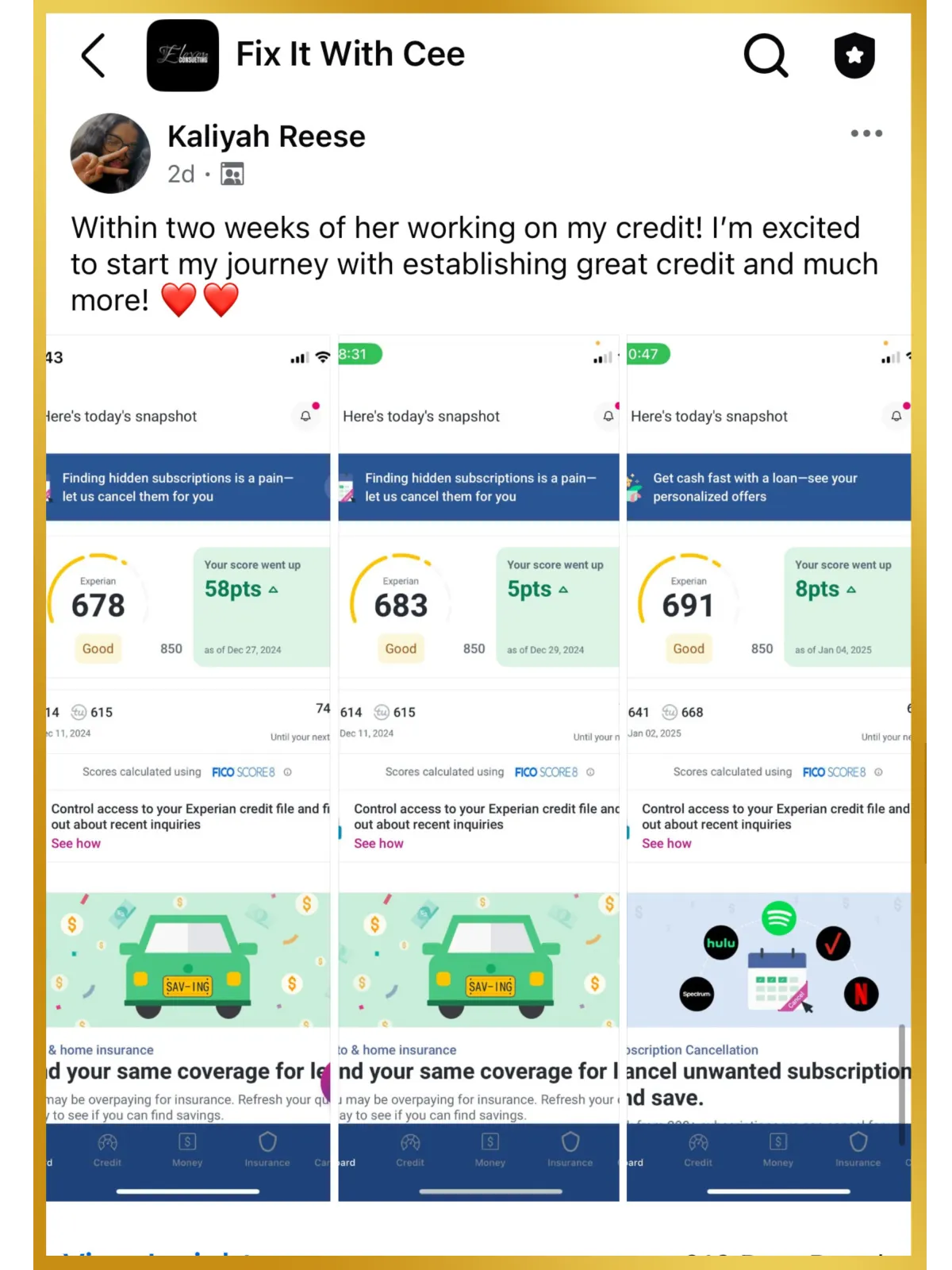

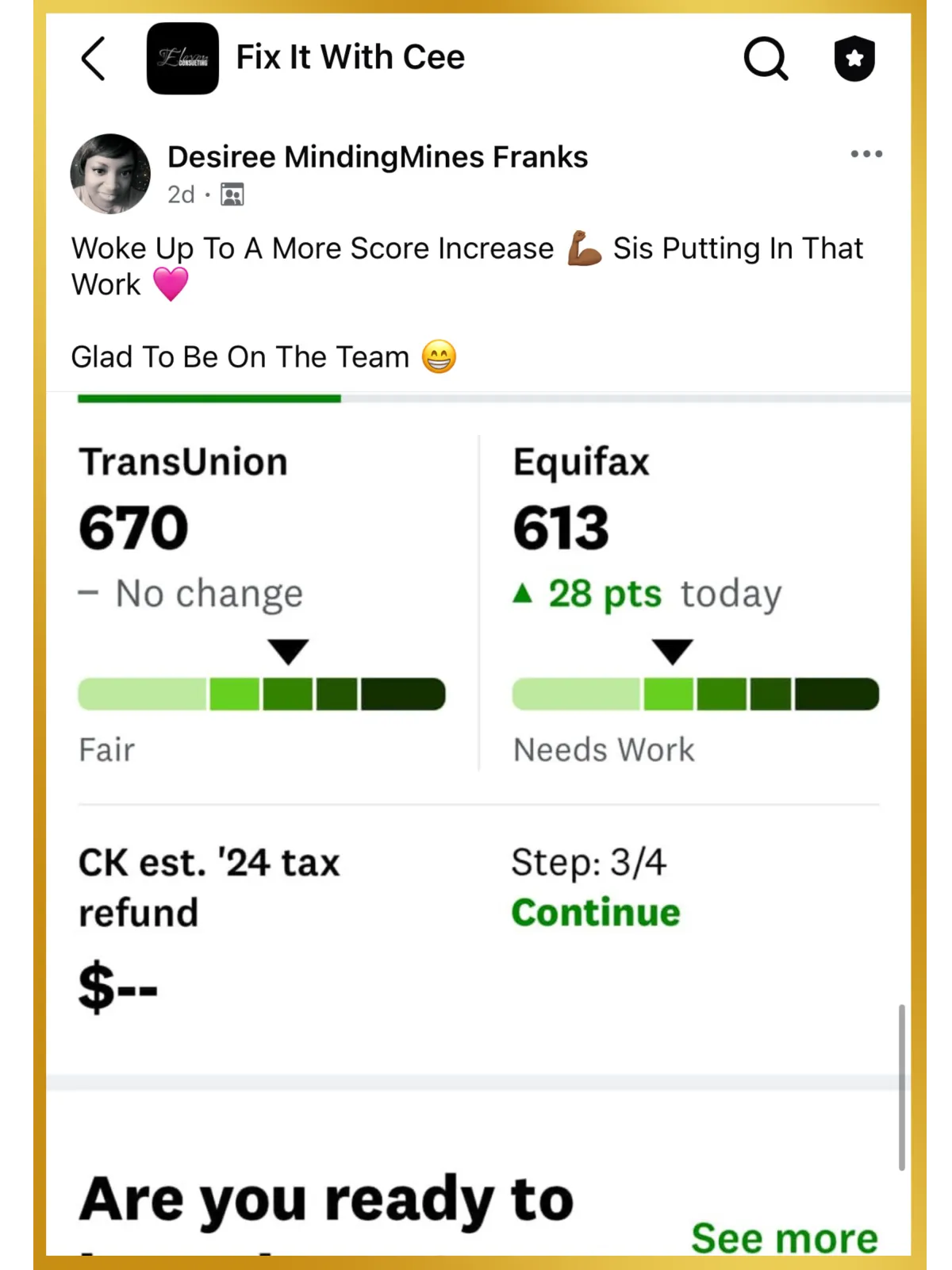

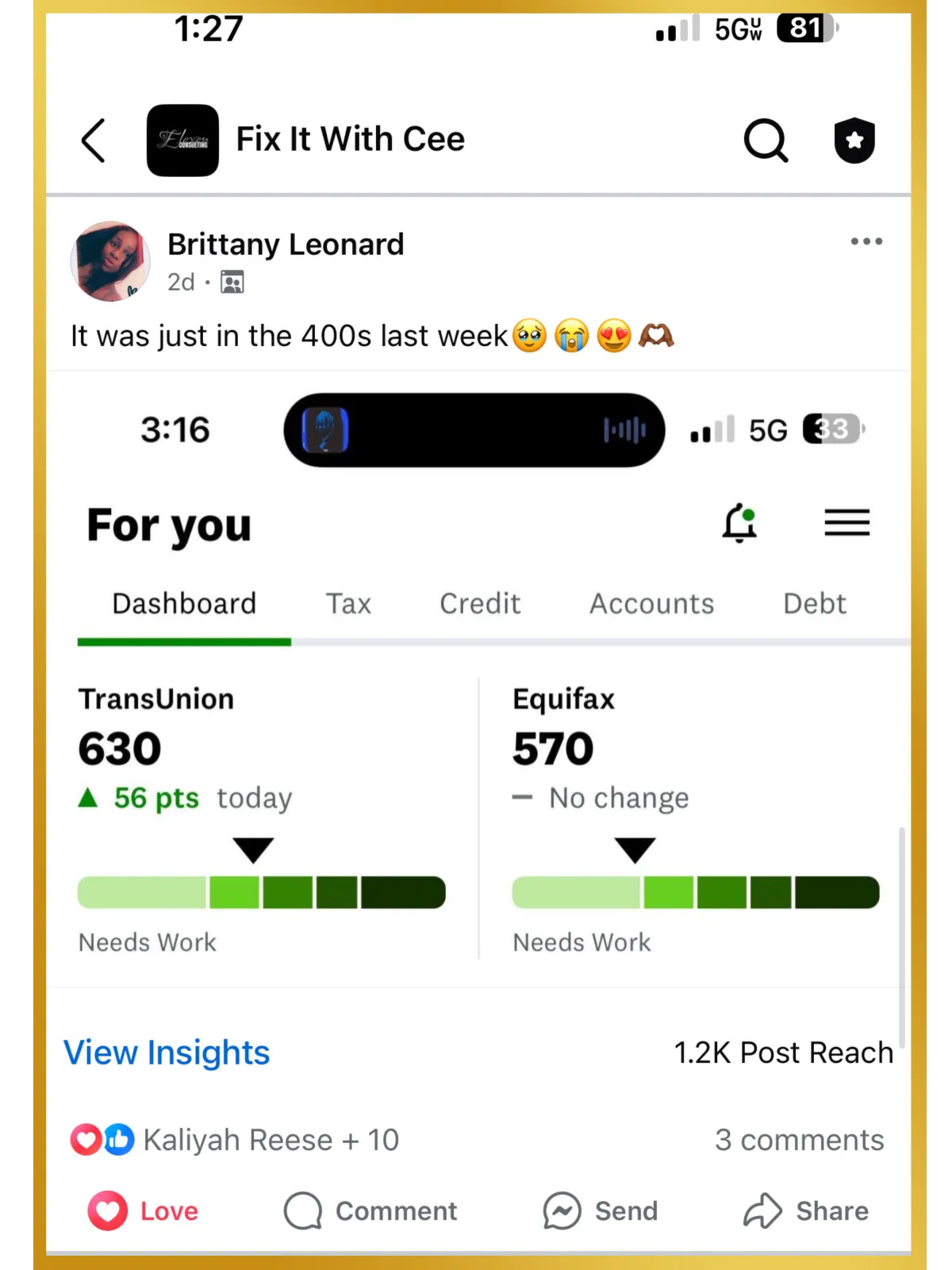

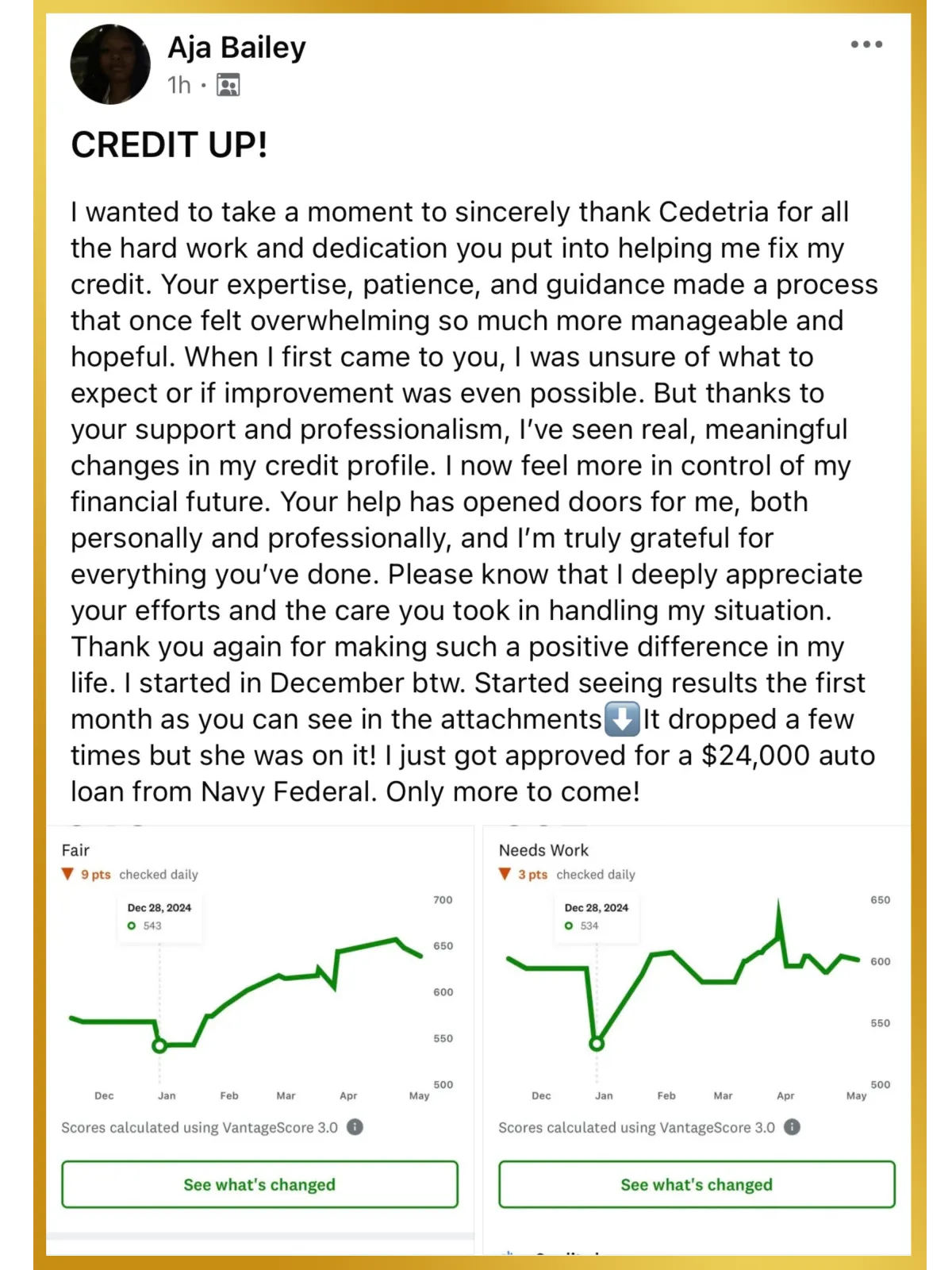

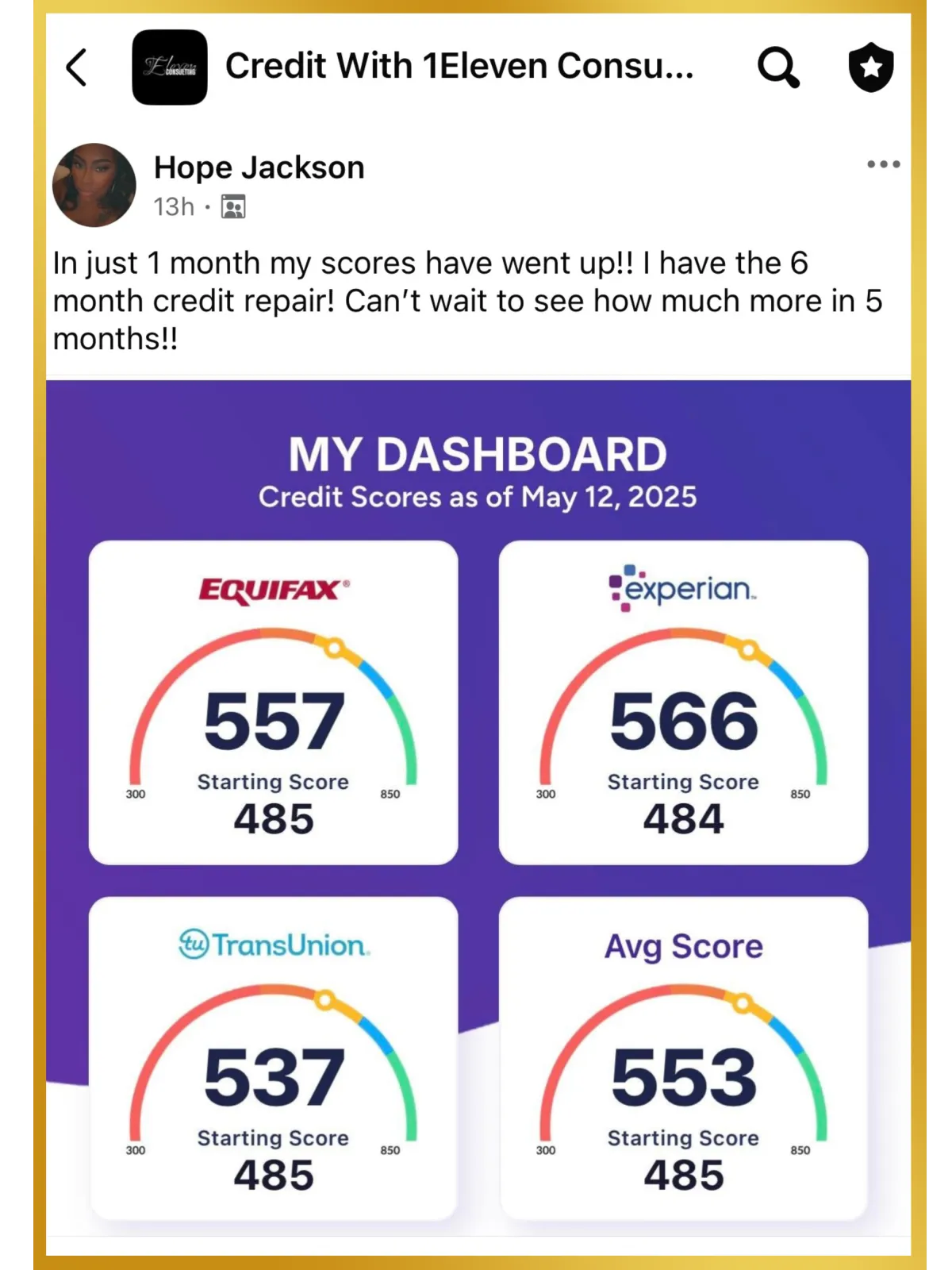

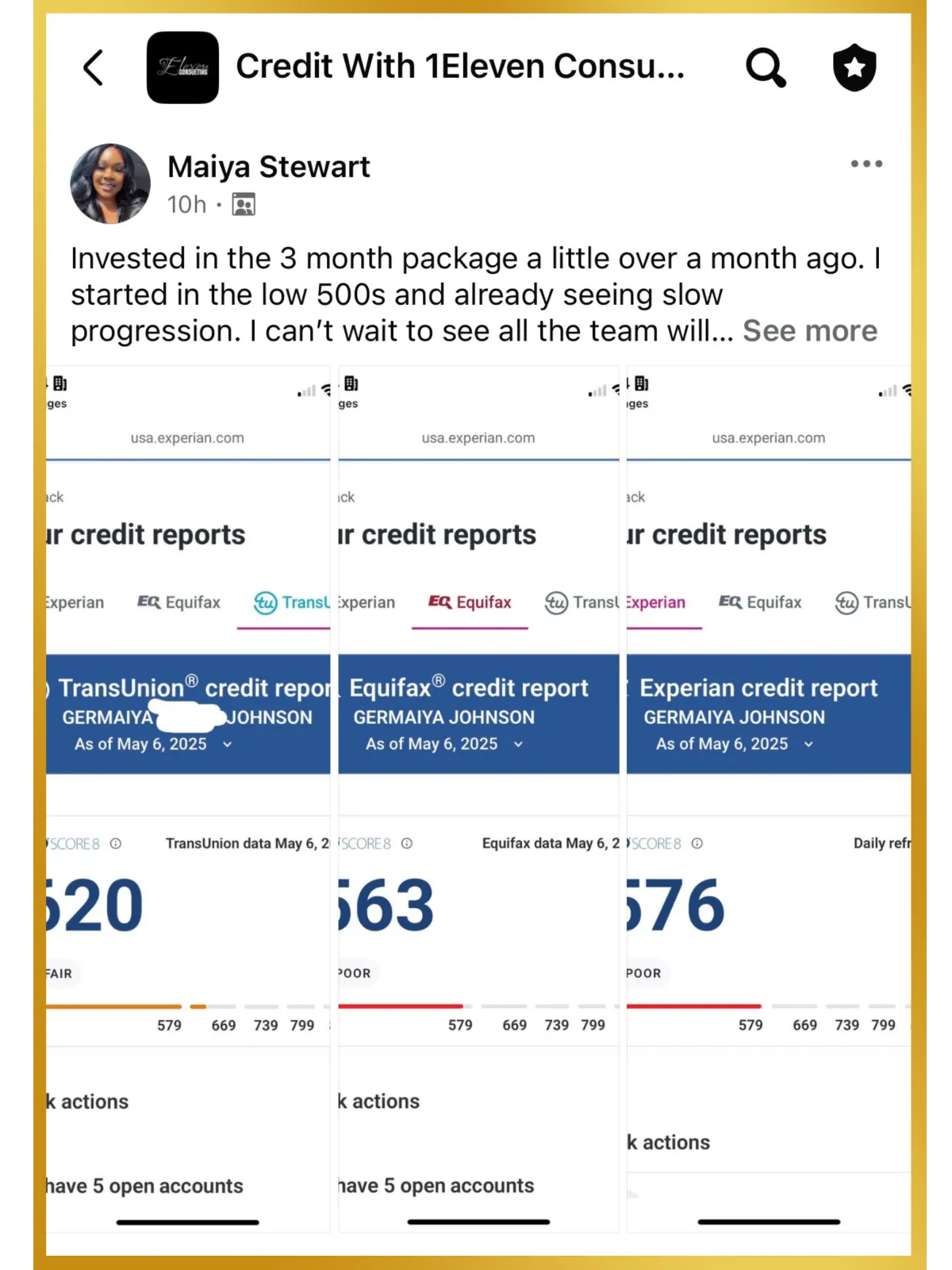

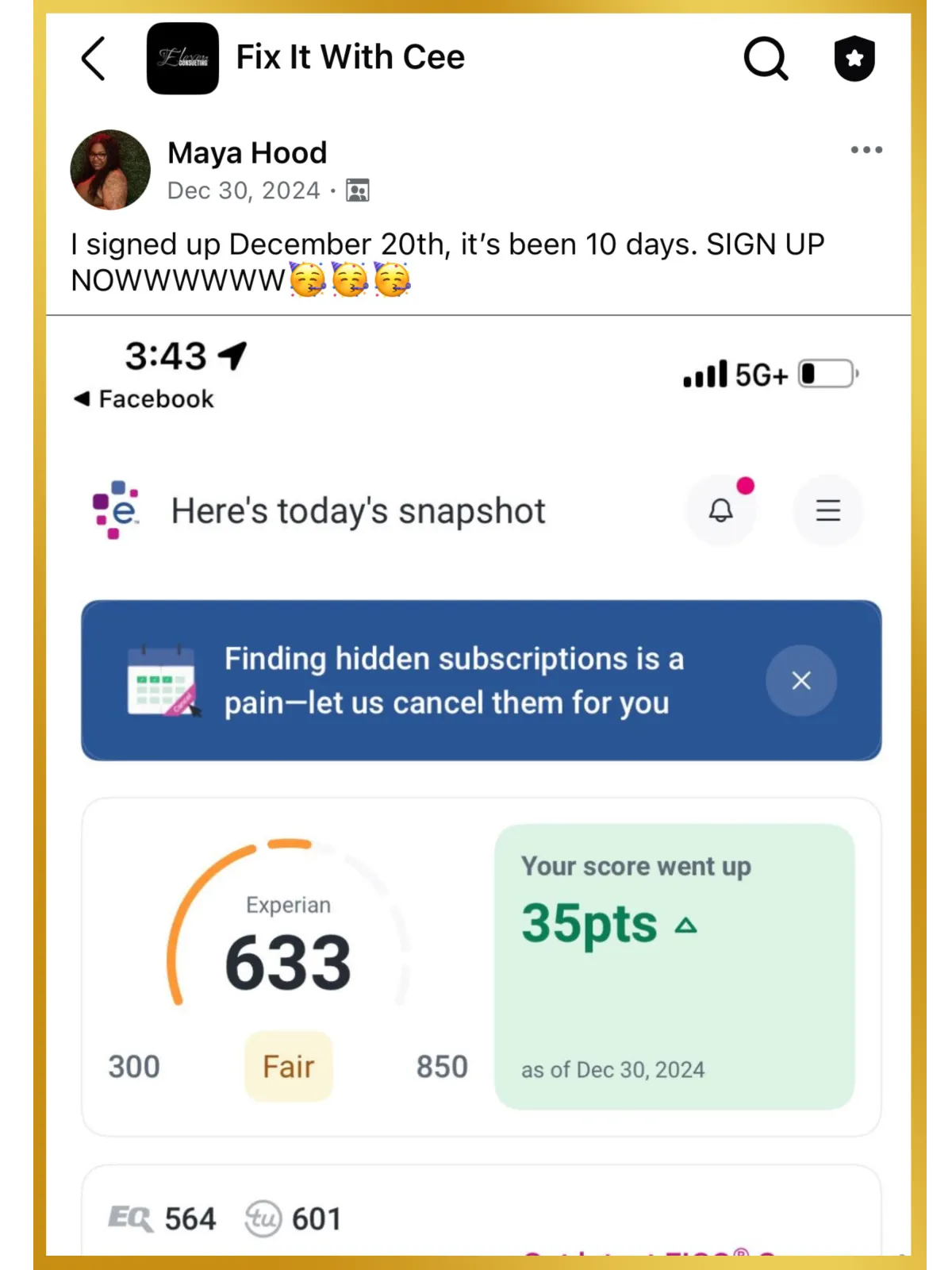

Results in as Little as 30–45 Days

Most clients see real score changes within their first billing cycle.

Custom Credit Repair Strategies

Every dispute is personalized to your credit goals — no cookie-cutter templates..

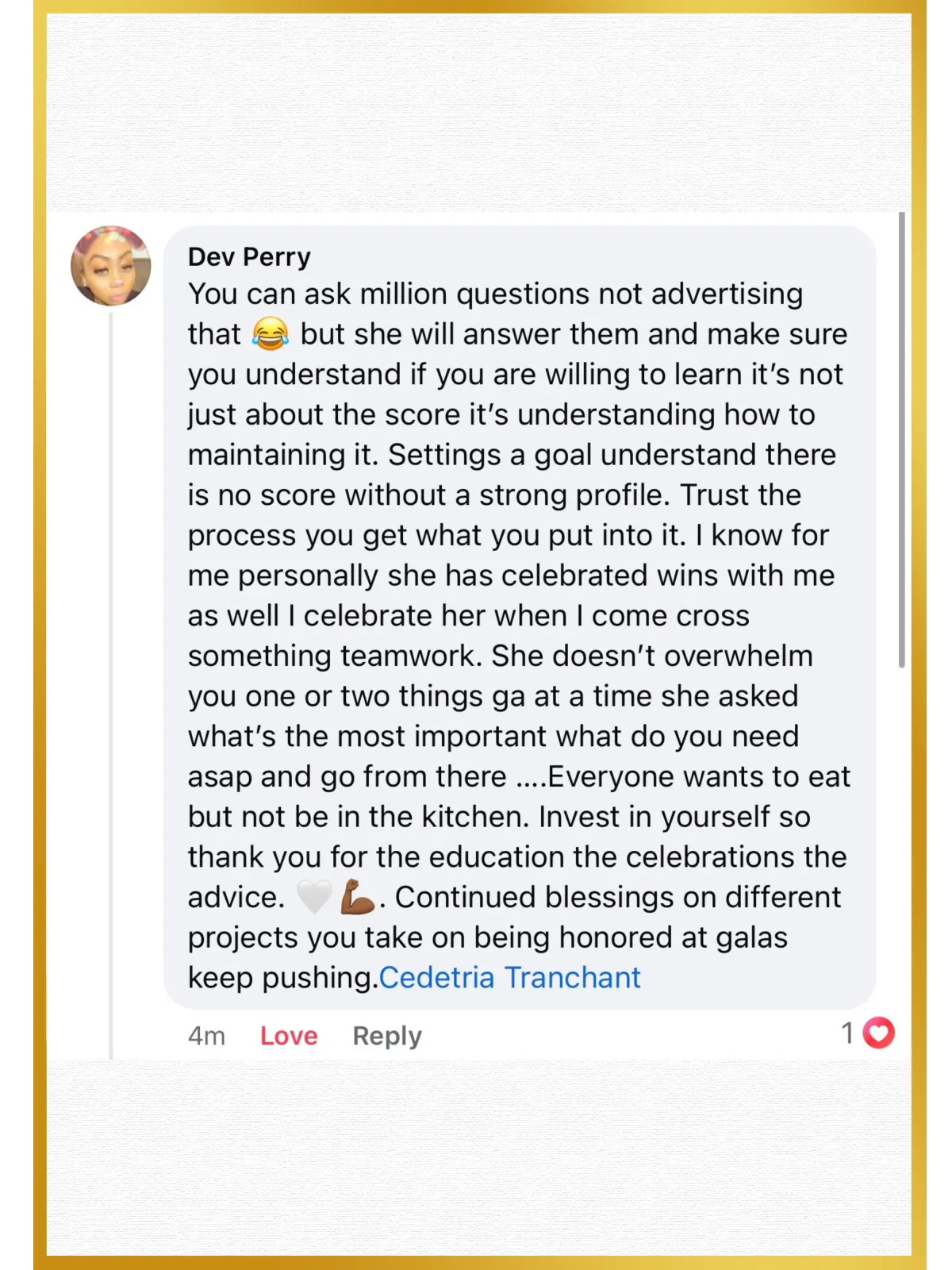

Support That Truly Cares

We guide and educate you every step — no jargon, just real help.

Transparent & Trustworthy Process

Track every dispute and see your results in real time inside your client portal.

⚡Fast Results | 💰Millions in Debt Erased | 🎯Expert Credit Strategists | 🔍Radical Transparency

Over $5M+ in Negative

Debt Removed

We’ve helped over 1,200 clients have erased collections, late payments, and more — for good.

Results in as Little

as 30–45 Days

Most clients see real score changes within their first billing cycle.

Custom Credit

Repair Strategies

Every dispute is personalized to your credit goals — no cookie-cutter templates..

Support That Truly Cares

We guide and educate you every step — no jargon, just real help.

Transparent & Trustworthy Process

Track every dispute and see your results in real time inside your client portal.

Foreclosures

Collections

Charge-offs

Student Loans

Judgements

Medical bills

Late Payments

Repossessions

Public Records

Bankruptcies

Child-Support

Hard Inquiries

Pick Your Program

Choose Singles or Couples Credit Transformation Accelerator. This decides which program fits your situation.

We Do The Hard Work

We look at your credit reports and challenge any wrong, old, or questionable items with Equifax, Experian, and TransUnion — so you don’t have to do it yourself.

See Your Progress

We keep track of what changes and update you along the way. You’ll know what we did and what to do next.

Meet

Cedetria Tranchant

Meet Cedetria Tranchant

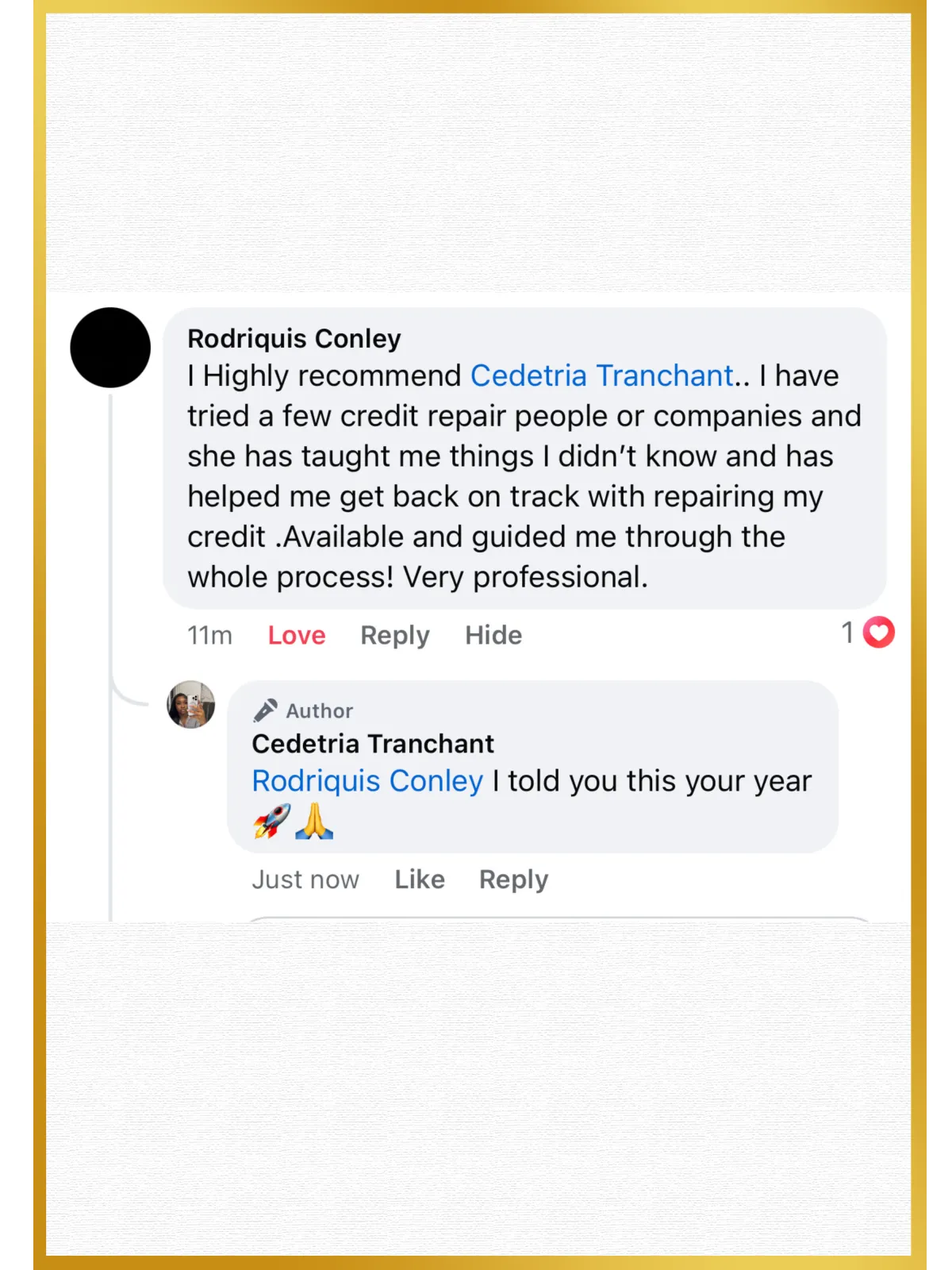

Hi, I’m Cedetria Tranchant, founder of 1Eleven Consulting. I know exactly how much great credit can change your life—because I’ve lived it. Not too long ago, my credit score was deep in the 400s. I was weighed down by debt, stressed about money, and constantly hearing “no” from lenders. It felt like my dreams were on hold. But I decided that bad credit wasn’t going to be the end of my story.

I dug in, learned the strategies, and put in the work—the very same methods I now share with my clients. In less than a year, I took my score from the 400s to the 800s. That change didn’t just improve my credit—it opened the door to a completely different life. I paid off debt, gained financial stability, and leveraged my credit to create cash flow and build wealth through real estate.

Now, I help others do the same. At 1Eleven Consulting, I work with individuals who are ready to repair their credit, rebuild their finances, and create a stronger foundation for their future. I’ve helped clients break free from debt, secure better lending opportunities, and finally feel in control of their financial lives.

What makes me different? I’ve been where you are. I understand the embarrassment of a credit denial, the frustration of debt, and the anxiety of feeling stuck. But I also know the freedom of breaking through those barriers and creating opportunities you once thought were out of reach.

If you’re ready to transform your credit, rebuild your finances, and open the door to new possibilities, I’m here to guide you every step of the way. Let’s make it happen—together.

Meet

Cedetria Tranchant

Meet Cedetria Tranchant

Hi, I’m Cedetria Tranchant, founder of 1Eleven Consulting. I know exactly how much great credit can change your life—because I’ve lived it. Not too long ago, my credit score was deep in the 400s. I was weighed down by debt, stressed about money, and constantly hearing “no” from lenders. It felt like my dreams were on hold. But I decided that bad credit wasn’t going to be the end of my story.

I dug in, learned the strategies, and put in the work—the very same methods I now share with my clients. In less than a year, I took my score from the 400s to the 800s. That change didn’t just improve my credit—it opened the door to a completely different life. I paid off debt, gained financial stability, and leveraged my credit to create cash flow and build wealth through real estate.

Now, I help others do the same. At 1Eleven Consulting, I work with individuals who are ready to repair their credit, rebuild their finances, and create a stronger foundation for their future. I’ve helped clients break free from debt, secure better lending opportunities, and finally feel in control of their financial lives.

What makes me different? I’ve been where you are. I understand the embarrassment of a credit denial, the frustration of debt, and the anxiety of feeling stuck. But I also know the freedom of breaking through those barriers and creating opportunities you once thought were out of reach.

If you’re ready to transform your credit, rebuild your finances, and open the door to new possibilities, I’m here to guide you every step of the way. Let’s make it happen—together.

STILL NOT SURE?

Frequently Asked Questions

Do I need a consultation before signing up?

No. A consultation is not required to enroll in our credit repair program.

Our service is fully done-for-you. Once you enroll, you’ll receive clear onboarding instructions and secure access to your client portal. Our team works behind the scenes to execute your credit repair, and all updates and communication are provided through email and the client portal so we can stay focused on results.

For clients who want additional clarity, planning support, or approval strategy, optional paid strategy calls are available. These calls are not required for credit repair services.

Strategy calls are designed for:

•Credit readiness review

•Approval planning (auto, home, funding)

•Next-step guidance

A current credit report is required for all strategy calls.

How long does it take to see results?

Most clients begin seeing noticeable improvements within 30 to 90 days.

Timelines depend on factors such as:

1. The number of negative items

2. How recent or severe those items are

3. Credit bureau response times

We begin working on your file as soon as onboarding is complete.

What Items Can you Remove?

We dispute closed negative accounts that may be inaccurate, incomplete, outdated, or unverifiable.

We do not:

Create false information

Remove accurate, verified, or current obligations

All work is done using consumer protection laws and compliant credit repair practices.

How can I improve my credit faster while working with you?

We guide you on:

Reducing utilization

Adding positive credit activity (when appropriate)

Avoiding common mistakes that slow progress

Credit repair works best when strategy + behavior are aligned — we help with both.

Where Can I See My Credit Reports? Is There a Charge for This?

We use MyFreeScoreNow so both you and our team can securely access your full credit reports from Experian, Equifax, and TransUnion.

MyFreeScoreNow charges a separate monthly fee of $29.90 for ongoing access to refreshed credit reports and scores. This service is required while you are enrolled so we can:

1. Monitor changes to your credit file

2. Identify updates and responses from the bureaus

3. Send accurate dispute rounds each month

You must remain active and up to date with your MyFreeScoreNow account for us to continue working on your credit file. This ensures transparency and allows you to track progress in real time.

How long does the credit repair process take?

Once all onboarding information has been received, please allow up to 2 business days for us to prepare and send your first dispute round to the three consumer reporting agencies (Experian, Equifax, and TransUnion). Once disputes are delivered, official processing time begins.

Your enrollment includes 6 dispute rounds, which typically spans up to 6 months. Each round is strategically timed to allow bureaus to investigate and respond before the next action is taken.

While every credit file is different, many clients begin seeing results within the first 30–90 days, with continued progress throughout the program.

Take Control of Your Credit Today!

Facebook

Instagram

TikTok

Mail